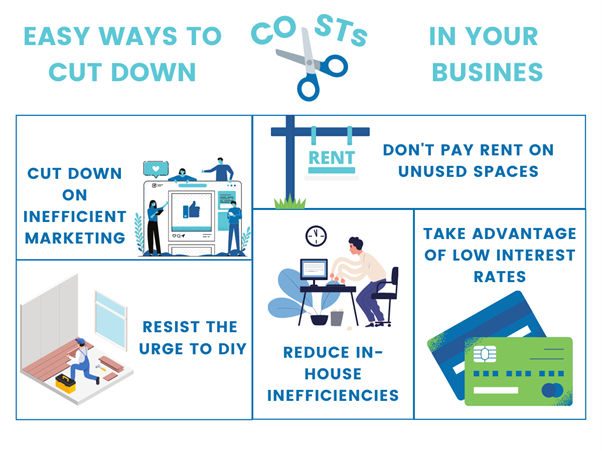

Easy Ways To Cut Down Costs In Your Business

August 13, 2021

There are many reasons your business might want to cut down on expenses, you could be having cashflow issues or you may want to enjoy extra profit.

It is important to assess the impact of every cost-reduction on your business, otherwise it may cost you more in the future.

We have compiled a list of often-overlooked ways that you can cut costs in your business.

Cut Down On Inefficient Marketing

When times are tough, it is usually recommended that you do not reduce your overall marketing budget. However, you should audit your marketing activities and expenditure to identify what is returning on investment, and what activities are underperforming.

Once you have identified what is not working for you, cut down on low-performing activities to reinvest in effective marketing strategies, all whilst sticking to your budget.

Reduce In-House Inefficiencies

Undergoing digital transformation in your business can be an effective way to remove any in-house efficiencies. You can achieve this by automating administration tasks, digitize staff rosters, automate inventory control, and more.

By digitally transforming your business, you can free up time for you and your staff, reduce errors, and reduce payroll funds spent on inefficient activities. This gives you and your team more time to work on generating more revenue.

Do Not Pay Rent On Unused Spaces

If your business has a physical presence, rent can be a major expense for your business. If you have extra space in your office, consider sub-letting part of it or renting out a few desks for people to use as a co-working space.

In the long term, consider moving to a smaller premise or run your business out of a co-working space.

Take Advantage Of Low Interest Rates

With interest rates at a record low, it may be a good time to invest in new equipment or an expansion of your business. Whilst spending money might seem counter-productive to cutting down costs, you may be saving money if you were going to make these upgrades in the near future.

Remember, you can also claim legitimate expenses and depreciation at tax time.

Resist The Urge To DIY

It can be tempting to save money by performing specialized tasks for your business yourself. However, unless it is a regular task you are able to upskill in, you may find it is cheaper to pay a professional to get it right.

This may involve sourcing the work of contractors or employees, either as a once-off or on an ongoing basis. It will likely save you valuable time and achieve better results for your business.

Trimming the financial fat in your business can be beneficial to most businesses.

However, it is important to ensure that you do not trim costs to the point where it negatively impacts how you operate or your customer’s experience with your business.

Acknowledgement Of Country

Business Foundations acknowledges the traditional custodians throughout Western Australia and their continuing connection to the land, waters and community. We pay our respects to all members of the Aboriginal communities and their cultures; and to Elders both past and present.

Victoria

The Commons

80 Market Street,

South Melbourne VIC 3205

admin@businessfoundations.com.au

Western Australia

Wesley Central

2 Cantonment Street,

Fremantle WA 6160

admin@businessfoundations.com.au

Get In Touch

Have a question or to find out how we can help you, please get in touch.