What Inflation Means For Your Business

April 28, 2023

Inflation can be a challenging problem for businesses, as it can lead to rising costs and reduced profits. In Australia, the inflation rate has been on the rise since mid-2022, and it is expected to continue to increase throughout 2023. In this article, we will discuss how businesses can cope with inflation in Australia in 2023.

What is inflation?

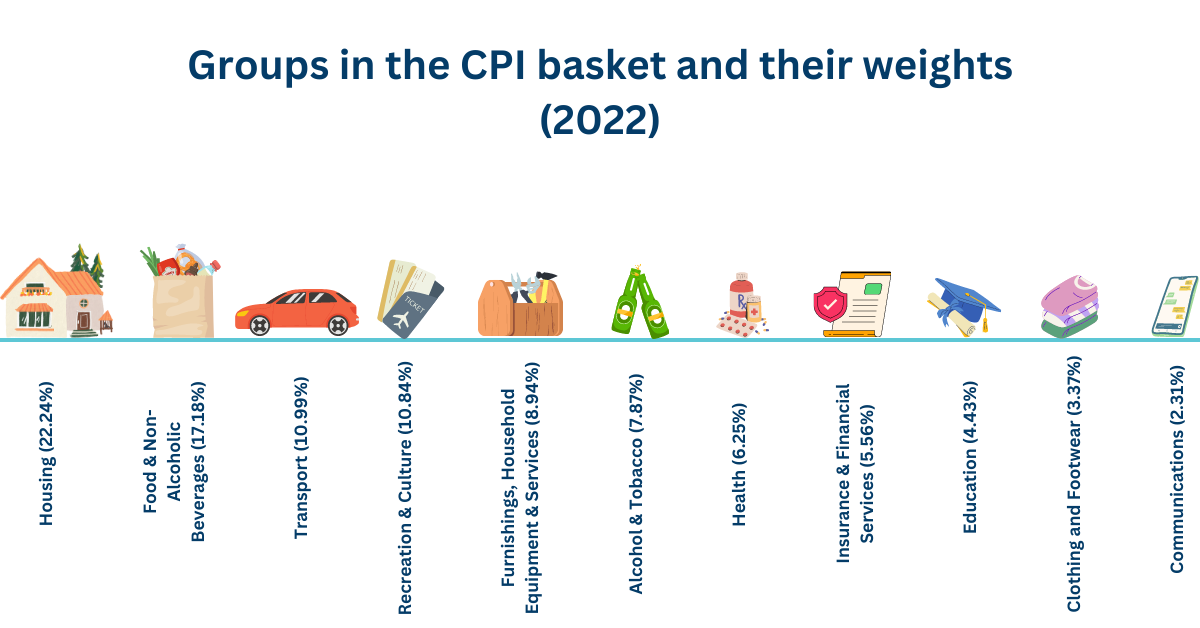

Inflation is a term used to describe a rise in the prices of goods and services. It is typically measured using the Consumer Price Index (CPI), which tracks the percentage change in the price of a basket of goods and services that households typically consume.

The main causes of inflation can be grouped into three broad categories:

1. Demand-pull: When people have an increase in disposable income, they are more likely to spend before they save, leading to more demand than supply.

2. Cost-push: The cost of production increases when there is a significant disruption to supply chains, pushing costs up.

3. Inflation expectations: These are beliefs that households and businesses have about future price increases. When businesses anticipate higher inflation and adjust their prices accordingly, this can lead to an acceleration of inflation. Similarly, if households expect inflation to rise, they may request higher wages to account for the anticipated increase in the cost of living, resulting in greater disposable income.

Inflation occurs naturally, however the current rate of inflation is considered extreme.

Why is inflation so high right now?

Australia’s current high inflation rate can be attributed to a variety of factors. The COVID-19 pandemic resulted in the abrupt closure of factories, effectively bringing supply chains to a standstill. Meanwhile, lockdowns resulted in a significant surge in demand for goods such as home entertainment, computers, and fitness equipment. More people were also able to save whilst they were prevented from going to the cinema, pub, or on an overseas holiday. Governments also provided stimulus payments to individuals who lost their jobs or experienced reduced working hours. These factors contributed to a demand-pull inflation scenario.

The recent invasion of Ukraine by Russia has disrupted the supply chains and caused cost-push inflation at a time when the economy was beginning to recover. The conflict has resulted in sanctions imposed on Russian exports, further exacerbating the supply chain issues. This has had significant impacts on the global market, particularly in key areas such as food, transport, energy, and financial markets. For instance, Russia and Ukraine supply a significant portion of the world’s wheat, corn, course grains, and sunflower oil, and the disruption has caused a 17% increase in global food prices. Additionally, Russia’s role as a major exporter of palladium, platinum, titanium, and fertilizers has led to price hikes in industries such as aviation, farming, and automotive. Furthermore, as a major player in the oil and energy industry, the conflict has pushed crude oil prices up to $112AUD a barrel.

The Impact of Inflation on Small Businesses

Higher Cost of Living Leads To Less Discretionary Income

Small businesses in Australia are facing a difficult situation as they try to balance rising expenses with the need to retain customers. Customers are diverting their spending away from non-essential goods and services to cover the increasing cost of living, leading to a decline in demand for discretionary goods. As a result, small business owners are finding themselves in a tricky position, needing to raise their prices to cover their increasing costs while avoiding driving customers away. According to the Airwallex Digital Economy Index for Q1 2023, Australians spent $124.1m less on online shopping than they did during the same period last year. The higher cost of doing business is being passed on to customers, many of whom are already experiencing stagnant wages. Research from the Commonwealth Bank shows that one in three small businesses are anticipating a drop in consumer demand. Demand for essential goods tends to remain stable during periods of inflation, whereas discretionary goods are more likely to be impacted.

Rising Cost of Doing Business

The rising cost of doing business is a challenge faced by many small business owners in the current economic climate. As inflation persists, it becomes increasingly difficult for small business owners to strike a balance between expenses and price increases. Fuel prices, for example, have increased, driving up the cost of delivery, while rents, utilities, and wages are also on the rise, driving up overhead costs. Additionally, carrying and purchasing inventory can become more expensive during inflationary periods. However, high inflation can also have a silver lining in that the value of existing inventory can rise as it was purchased with “older” money.

Increased Borrowing Costs

Small business owners are facing increased borrowing costs due to the current economic climate, in which interest rates have risen to combat inflation. The official cash rate now stands at 3.6%, a stark contrast to the rock-bottom interest rates of just 12 months ago, which encouraged businesses to borrow heavily. Interest rates are one of the primary tools used by the Reserve Bank to fight inflation, but they come at a cost for borrowers. Small business owners seeking to invest in their business’s future or secure working capital must now contend with higher borrowing costs, which can significantly impact their bottom line. This increased cost of borrowing may lead some businesses to reassess their financial priorities, potentially slowing growth or delaying expansion plans.

Impacting Business Decisions

Inflation has a profound impact on small businesses, influencing their decisions in numerous ways. To mitigate the risks and challenges associated with inflation, small business owners may opt to cut back on certain expenses. This can include delaying new product launches, cutting back on marketing spending, repairing equipment rather than replacing it to save costs, and terminating certain product or service offerings. Additionally, businesses may opt to cut travel expenses or use less expensive materials in their products. To manage payroll costs, small businesses may freeze hiring, prohibit overtime for employees, or lay off staff, reduce shifts, or assign fewer weekly hours. They may also delay personnel decisions such as promotions or bonuses, requiring salaried employees to take on more responsibility. The willingness to take financial risks may be reduced as well, as small business owners focus on weathering the inflationary storm and maintaining profitability.

Strategies to Survive Rising Inflation

Small businesses facing the challenges of rising inflation may wonder how best to weather the storm. While it is impossible to predict when inflation will ease up or what will happen next, there are several strategies that small business owners can implement to survive in a high inflation environment. One such strategy is to control costs without sacrificing quality, which can include measures such as renegotiating contracts with suppliers or optimizing inventory management. Another key approach is to manage customer expectations by communicating the reasons behind price increases and offering discounts or promotions where appropriate. Finally, small business owners may need to adjust their plans to meet the increased cost of doing business, such as delaying expansion or reevaluating their marketing and advertising strategies. By following these three pieces of advice, small businesses can better position themselves to succeed in an inflationary environment.

Inflation can be a significant challenge for small businesses as it can lead to rising costs, reduced profits, and a decline in demand for discretionary goods. Coping with inflation in Australia in 2023 will require businesses to implement strategies such as diversifying their supply chains, adopting new technologies to improve efficiency and productivity, and exploring alternative financing options to reduce the impact of borrowing costs on their bottom line.

Acknowledgement Of Country

Business Foundations acknowledges the traditional custodians throughout Western Australia and their continuing connection to the land, waters and community. We pay our respects to all members of the Aboriginal communities and their cultures; and to Elders both past and present.

Victoria

The Commons

80 Market Street,

South Melbourne VIC 3205

admin@businessfoundations.com.au

Western Australia

Wesley Central

2 Cantonment Street,

Fremantle WA 6160

admin@businessfoundations.com.au

Get In Touch

Have a question or to find out how we can help you, please get in touch.